The year 2024 brings a plethora of updates to the Medicare program, several significantly impacting skilled nursing facilities (SNFs). SNF staff must stay well informed about these updates to ensure proper billing and adequate coverage for a beneficiary’s skilled stay. This comprehensive article delves into key updates, encompassing changes in Medicare Part A and B premiums and deductibles, updates to Medicare Part C coverage, the Patient-Driven Payment Model (PDPM) rate adjustments, SNF consolidated billing modifications, and upcoming changes to the SNF Quality Reporting Program (QRP).

Medicare Part A Costs

One of the fundamental changes in 2024 is the adjustment to the Medicare Part A deductible and premiums. Medicare Part A, covering hospital stays, SNF care, hospice care, and home health care, is premium free for beneficiaries who have worked and paid into Social Security for at least 10 years. For those not eligible for premium-free Medicare Part A, the monthly premium for 2024 is either $278 or $505, contingent on the beneficiary’s or spouse’s work history (CMS, n.d.).

Additionally, beneficiaries will face a slight increase in the deductible amount before Medicare coverage initiates. The specifics of these changes are outlined in the chart below, adapted from information on the Costs webpage of Medicare.gov:

| Provider | 2023 Costs | 2024 Costs |

| Inpatient hospital | • $1,600 deductible per benefit period • $0 for the first 60 days of each benefit period • $400/day for days 61–90 • $800/day for days 91–150 • Days of inpatient hospital stay from day 151 are not covered under Medicare Part A* | • $1,632 deductible per benefit period • $0 for the first 60 days of each benefit period • $408/day for days 61–90 • $816/day for days 91–150 • Days of inpatient hospital stay from day 151 are not covered under Medicare Part A* |

| SNF | • $0 for the first 20 days of each benefit period • $200 for days 21–100 • Beneficiary pays all costs for days 101+* | • $0 for the first 20 days of each benefit period • $204 for days 21–100 • Beneficiary pays all costs for days 101+* |

| Hospice | • Beneficiary has $0 deductible • Copayment of up to $5 per prescription drug for pain and symptom management • 5% of Medicare daily payment rate for inpatient respite care • Medicare does not pay for room and board when receiving hospice care at home or another facility, such as a SNF | • Beneficiary has $0 deductible • Copayment of up to $5 per prescription drug for pain and symptom management • 5% of Medicare daily payment rate for inpatient respite care • Medicare does not pay for room and board when receiving hospice care at home or another facility, such as a SNF |

| Home health | • Beneficiary has $0 deductible • 20% of Medicare-approved amount for Medicare-covered medical equipment (durable medical equipment) | • Beneficiary has $0 deductible • 20% of Medicare-approved amount for Medicare-covered medical equipment (durable medical equipment) |

*Costs for inpatient hospital stays from day 151 and SNF services from day 101 are not covered under Medicare Part A. The beneficiary may have a secondary pay source, such as Medicaid or private insurance. If there are no secondary pay sources, the resident must pay privately if he or she wishes to continue receiving care in the facility.

Source: Adapted from Costs by the Centers for Medicare & Medicaid Services, n.d., https://www.medicare.gov/basics/costs/medicare-costs.

It is crucial for SNFs to stay informed about these modifications to ensure accurate billing.

Medicare Part B Costs

Medicare Part B, responsible for covering outpatient care, doctor visits, and preventive services, has also increased the costs for beneficiaries. In 2024, the Part B standard premium is $174.70 per month, with a deductible of $240.00 per year. Higher income beneficiaries have increased premiums. Part B typically covers 80% of the Medicare-approved amount of the service, with the remaining 20% paid by the beneficiary as a copay (CMS, n.d.).

As part of Medicare Part B therapy billing, a KX modifier is required on the claim when services exceed a monetary threshold to attest that the services are both medically necessary and supported by documentation. For 2024, the threshold is $2,330 for physical therapy (PT) and speech language pathology (SLP) services combined, and $2,330 for occupational therapy (OT) services. These costs reflect an increase of $100 from the 2023 threshold. Additionally, there is a targeted medical review threshold of $3,000 for PT and SLP services combined, and $3,000 for OT services, remaining constant until 2028. Claims above this threshold may be subject to medical review (CMS, 2023a).

Medicare Part C Coverage Updates

Medicare Part C, also known as Medicare Advantage (MA), is a private insurance plan that covers both Part A and Part B benefits. The 2024 Medicare Advantage and Part D Final Rule clarifies that MA plans must follow Medicare coverage requirements addressed in National and Local Coverage Determinations and general and benefit conditions included in traditional Medicare regulations (CMS, 2023b). This update is welcome because MA plans historically used other methods to determine skilled coverage. Only when Medicare coverage criteria are not fully established can MA plans create their own coverage criteria.

The 2024 Medicare Advantage and Part D Final Rule (CMS-4201-F) fact sheet from the Centers for Medicare & Medicaid Services (CMS) indicates the rule also “streamlines prior authorization requirements” that includes use of prior authorization only to confirm the presence of a diagnosis or other medical criteria to ensure the care is medically necessary (CMS, 2023c). SNFs need to assess these changes to understand how they may impact the care they offer associated with MA plans.

Collaboration between SNFs and MA plans becomes increasingly important in light of these updates. SNF administrators and healthcare providers should engage with insurers to ensure a seamless transition and clear communication regarding the changes in coverage.

Note: To get a deeper dive into the new requirements published in the 2024 Medicare Advantage and Part D Final Rule and how to hold managed care insurers accountable, don’t miss the session, “New Rules for Managed Care: How to Hold MCOs Accountable” presented by Maureen McCarthy, RN, BSN, RAC-MT, QCP-MT, DNS-MT, RAC-MTA, Celtic Consulting, AAPACN board member, on Thursday, April 11, 2024, at 2:45 pm ET, during the AAPACN 2024 Conference in Hollywood, FL.

PDPM Updates

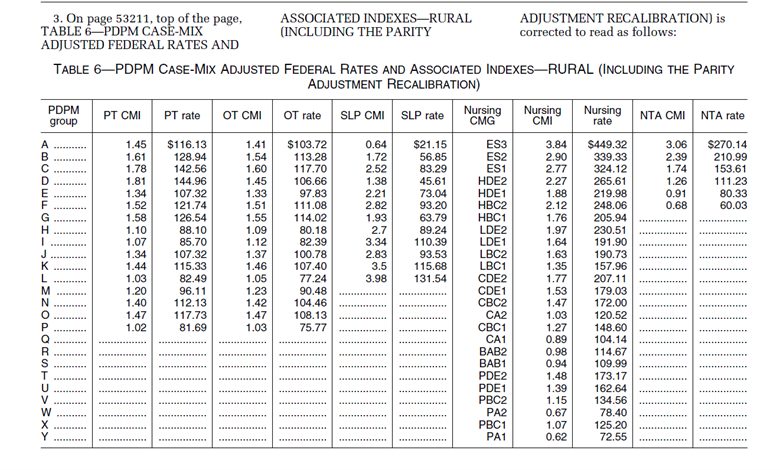

In October 2023, CMS implemented an update to the federal base rates for each of the five case-mix adjusted components of PDPM as well as completing the case-mix index (CMI) parity adjustment for fiscal year (FY) 2024. The following charts from the FY 2024 SNF PPS Final Rule correction show these changes (HHS, 2023a).

CMG, case-mix group; NTA, Non-Therapy Ancillary.

Source: From Federal Register: Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2024; Correction published by the Department of Health and Human Services, 2023, https://www.federalregister.gov/documents/2023/10/04/2023-22050/medicare-program-prospective-payment-system-and-consolidated-billing-for-skilled-nursing-facilities.

Of note, the annual update to the PDPM ICD-10 Mapping reflects changes finalized in the FY 2024 SNF Prospective Payment System (PPS) Final Rule. Thus, the appropriate fiscal year mapping tool must be reviewed when considering International Classification of Diseases, Tenth Revision, Clinical Modification (ICD-10-CM) coding on the Minimum Data Set (MDS).

Note: For an overview of the basics of ICD-10-CM coding and how diagnosis codes impact PDPM, billing, Quality Measures, and MDS accuracy, don’t miss the session, “ICD-10-CM Coding Basics” presented by Carol Maher, RN-BC, RAC-MTA, RAC-MT, CPC, Hansen Hunter & Co, on Saturday, April 13, 2024, at 10 am ET, during the AAPACN 2024 Conference.

SNF Consolidated Billing

SNF consolidated billing is a critical aspect of Medicare reimbursement for SNFs. It involves the bundling of payment for various services provided to Medicare beneficiaries within the SNF setting. Certain high-cost and low-probability items are excluded, and consolidated billing exclusion lists are updated annually on CMS’s SNF Consolidated Billing webpage.

Outside vendors must submit an itemized bill to the SNF for any services rendered while a resident is in a Medicare Part A skilled stay. The SNF billing staff must review the itemized claims from the outside vendors to ensure these items are in fact the responsibility of the SNF under consolidated billing. The vendor should then bill excluded items directly to Medicare.

SNF billers can review the exclusion list for the appropriate billing dates from the website just cited. Updates from Part B and Part A are listed on the left side of the webpage and used by billing staff to ensure the SNF is paying appropriately. At the bottom of the page for the corresponding update year, the annual SNF Consolidated Billing HCPCS Update file can be downloaded. Most items in this spreadsheet are excluded from consolidated billing, apart from items listed as inclusions (Major Category I, F: Outpatient Surgery and Related Procedures, and Major Category V, A: Therapies).

In addition to the Healthcare Common Procedure Coding System (HCPCS) Annual update, the current General Explanation of the Major Categories for Skilled Nursing Facility (SNF) Consolidated Billing effective for that fiscal year can be found here. The changes made to HCPCS for FY 2024 were effective October 1, 2023. The full list of updates can be found here. The April 2024 Quarterly update adds several more HCPCS codes to the table, effective Jan. 1, 2024. These additions can be found on CMS Transmittal 12449.

Also, the FY 2024 SNF PPS Final Rule changed regulatory text to exclude Marriage and Family Therapist and Mental Health Counselor services from SNF consolidated billing, effective Jan. 1, 2024 (HHS, 2023b).

SNF administrators and billing departments must stay abreast of these changes to maintain compliance and optimize revenue cycles. Understanding the intricacies of SNF consolidated billing is essential for financial sustainability in the evolving Medicare landscape.

Upcoming Changes to SNF QRP

SNF QRP plays a pivotal role in monitoring and improving the quality of care provided to Medicare beneficiaries. A new measure was finalized in the FY 2024 SNF PPS Final Rule, the COVID-19 Vaccine: Percent of Patients/Residents Who Are Up to Date, and it will begin data collection on Oct. 1, 2024, (HHS, 2023b). The recently released draft MDS Item Sets, version 1.19.1 reflect this measure with the addition of O0350, Resident’s COVID-19 vaccination is up to date. This data will be used to inform the FY 2026 SNF QRP.

Source: From “Minimum Data Set (MDS) – Version 3.0, Resident Assessment and Care Screening, Nursing Home Comprehensive (NC) Item Set, version 1.19.1, effective October 1, 2024, page 45. https://www.cms.gov/files/zip/mds30draftitemsetsv1191foroct12024.zip

In addition, the FY 2024 SNF PPS Final Rule outlined the adoption of the Discharge Function Score measure beginning with the FY 2025 SNF QRP. No MDS changes were required for this new measure because the information is already collected on the current version of the MDS. This measure replaces the Application of Percent of LTCH [long-term care hospitals] Patients with an Admission and Discharge Functional Assessment with a Care Plan That Addresses Function that stopped data collection of discharge goal (column 2) of MDS items GG0130 and GG0170 as of Oct. 1, 2023. The discharge goal column will not be removed from the MDS Item Sets until v1.19.1, effective Oct. 1, 2024 (HHS, 2023b). Although SNFs will continue to receive an Annual Payment Update (APU) warning if the MDS is submitted without at least one self-care or mobility discharge goal, CMS has assured SNFs that they can ignore this warning on page 1 of the Skilled Nursing Facility Quality Reporting Program (SNF QRP) Overview of Data Elements Used for Reporting Assessment-Based Quality Measures and Standardized Patient Assessment Data Elements Affecting FY 2025 Annual Payment Update (APU) Determination.

Another change from the FY 2024 SNF PPS Final Rule, effective Jan. 1, 2024, is the increase in the SNF QRP MDS data completion threshold from 80% to 90%. This means that 100% of the required MDS data must be collected on 90% of the Medicare assessments submitted to the Internet Quality Improvement and Evaluation System (iQIES). The number of QRP items collected on the MDS has increased significantly, effective Oct. 1, 2023 (HHS, 2023b). The MDS items collected for calendar year 2024 can be found in the SNF QRP overview of data elements listed above. A dash in one of these data elements will impact the APU determination for Medicare assessments.

Although not a change for 2024, it’s important to note that to achieve compliance with the APU threshold and avoid the APU reduction, CMS also requires facilities to submit 100% of the monthly healthcare personnel (HCP) COVID-19 vaccination data and annual flu vaccine data to the National Healthcare Safety Network (NHSN) (CMS, 2023d). More information on NHSN requirements can be found in these CDC resources: NHSN Healthcare Personnel (HCP) Flu Vaccination Module for SNF QRP Reporting and NHSN LTCF COVID-19/Respiratory Pathogens Vaccination Module Page. Here are some essential considerations to avoid the NHSN APU reduction:

- Who submits the weekly COVID-19 HCP vaccine data? Who is the backup?

- Who submits the HCP flu vaccine data for the entire flu season by May 15?

- Is proof of submission reviewed regularly?

SNF staff may want to consider review of these items during weekly Medicare and monthly triple-check meetings to ensure no data is omitted.

Conclusion

As SNFs navigate the landscape of Medicare updates in 2024, adaptability and proactive planning is key. The changes in Medicare Part A deductible and premiums, Medicare Part B costs, Medicare Part C coverage updates, SNF consolidated billing, PDPM cost updates, and upcoming alterations to SNF QRP all contribute to a shifting healthcare environment.

SNFs that stay informed, collaborate with stakeholders, and address these changes proactively will be better positioned to offer exceptional care to their residents while ensuring financial sustainability in the ever-evolving world of Medicare. By embracing these changes, SNFs will not only meet regulatory requirements, but they will also contribute to the continuous improvement of healthcare delivery in their communities. SNFs can assist beneficiaries to navigate other major changes in their Medicare coverage by reviewing the annual official U.S. government Medicare handbook: Medicare and You 2024.

References

Centers for Medicare & Medicaid Services. (n.d.) Costs. https://www.medicare.gov/basics/costs/medicare-costs

Centers for Medicare & Medicaid Services. (2023a). Therapy services. Modified December 28, 2023. https://www.cms.gov/medicare/coding-billing/therapy-services

Centers for Medicare & Medicaid Services. (2023b). Medicare program; contract year 2024 policy and technical changes to the medicare advantage program, medicare prescription drug benefit program, medicare cost plan program, and programs of all-inclusive care for the elderly. https://www.federalregister.gov/documents/2023/04/12/2023-07115/medicare-program-contract-year-2024-policy-and-technical-changes-to-the-medicare-advantage-program

Centers for Medicare & Medicaid Services. (2023c). Fact sheet: 2024 Medicare advantage and part d final rule (CMS-4201-F). https://www.cms.gov/newsroom/fact-sheets/2024-medicare-advantage-and-part-d-final-rule-cms-4201-f

Centers for Medicare & Medicaid Services. (2023d). Skilled Nursing Facility (SNF) Quality Reporting Program (QRP) Frequently Asked Questions (FAQs). https://www.cms.gov/files/document/fy2024-snf-qrp-faqs.pdf

Department of Health and Human Services. (2023a). Medicare program; prospective payment system and consolidated billing for skilled nursing facilities; updates to the quality reporting program and value-based purchasing program for federal fiscal year 2024; correction. 88 FR 68486 (effective October 1, 2023). Centers for Medicare & Medicaid Services. https://www.federalregister.gov/documents/2023/10/04/2023-22050/medicare-program-prospective-payment-system-and-consolidated-billing-for-skilled-nursing-facilities

Department of Health and Human Services. (2023b). Medicare program; prospective payment system and consolidated billing for skilled nursing facilities; updates to the quality reporting program and value-based purchasing program for federal fiscal year 2024. 88 FR 53200 (effective October 1, 2023). Centers for Medicare & Medicaid Services. https://www.federalregister.gov/documents/2023/08/07/2023-16249/medicare-program-prospective-payment-system-and-consolidated-billing-for-skilled-nursing-facilities

This AAPACN resource is copyright protected. AAPACN individual members may download or print one copy for use within their facility only. AAPACN facility organizational members have unlimited use only within facilities included in their organizational membership. Violation of AAPACN copyright may result in membership termination and loss of all AAPACN certification credentials. Learn more.